nebraska auto sales tax

Nebraska car sales tax is 55 for any new or used car purchases. Qualified businessprofessional use to view vehicle.

Nebraska Car Sales Tax Reviews And Estimates Getjerry Com

Nebraska Exemption Application for Common or Contract Carriers Sales and Use Tax - Includes Schedule A 072018 5.

. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car. Said simply Nebraska will only tax the price of a vehicle after the trade-in credit has been subtracted.

If you are registering a motorboat contact the Nebraska Game and Parks Commission. 49 rows Nebraska Exemption Application for Sales and Use Tax 062020 4. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax.

Refer to Sales Tax Regulation 1-006 Retail Sale or Sale at Retail and Local Sales and Use Tax Regulation 9-007 Cities Change or Alteration of City Boundaries. Services are generally taxed at the location where the service is provided to the customer. Several counties have only the statewide sales tax rate of 55 without any additional city or county tax.

Here are five additional taxes and fees that go along with a vehicle purchase. NE Sales Tax Calculator. 02003A The tax due shall be computed on the difference between the.

2020 rates included for use while preparing your income tax deduction. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. The Nebraska state sales and use tax rate is 55 055.

Which county in Nebraska has the lowest tax. The state of NE like most other states has a sales tax on car purchases. The Nebraska sales tax on cars is 5.

When state and county rates are added the average car sales tax becomes 6324. Rates include state county and city taxes. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918.

To remain in Nebraska more than 30 days from the date of purchase. The sales tax on a used vehicle in Nebraska is 55 the same as a new car purchase. Current Local Sales and Use Tax Rates Vehicles Towed from Private PropertyVehicles Left Unattended on Private Property Transfer of Ownership.

The latest sales tax rates for cities in Nebraska NE state. Deliveries into another state are not subject to Nebraska sales tax. Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales.

A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. Also effective October 1 2022 the following cities. Imagine youre shopping for a new Hummer which costs roughly 36000.

Printable PDF Nebraska Sales Tax Datasheet. Nebraska taxes vehicle purchases after rebates or incentives are applied to the price which. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser.

Purchase of a 30-day plate by a nonresident of Nebraska who does not intend. Nebraska vehicle title and registration resources. Sales and Use Tax Regulation 1-02202 through 1-02204.

These cities include Author Banner Blaine Cherry Haves Hitchcock Logan Loup McPherson Thomas and. Nebraska Sales Tax on Cars. Municipal governments in Nebraska are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 0825 for a total of 6325.

The sale state on the sales invoice the dollar amount of the tax and furnish the purchaser a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. Money from this sales tax goes towards a whole host of state-funded projects and programs. Vehicle Title Registration.

Advertisements Unlawful 052018 Agricultural Machinery and Equipment Sales Tax Exemption 092020 Animal Specialty Services 082003 Auction Sales 052022 Auto Body Specialists 032004 - contains information updated 122009 Bars Taverns and Restaurants 032007 Building Cleaning and Maintenance 092003 - contains information updated 012013. Nebraska SalesUse Tax and Tire Fee Statement. This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax.

Many dealers offer cash incentives or manufacturer rebates on the sticker price of a vehicle in order to encourage sales. Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15.

Register the vehicle and pay sales tax. For example a 1000 cash rebate may be offered on a 10000 car meaning that the out of pocket cost to the buyer is 9000. Nebraska has a statewide sales tax rate of 55 which has been in place since 1967.

Failure to do so is a Class IV felony.

Sales Tax On Cars And Vehicles In Nebraska

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

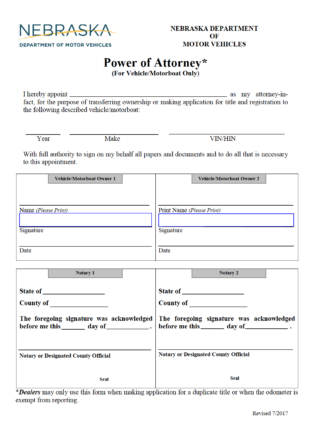

Free Nebraska Motor Vehicle Dmv Power Of Attorney Pdf Word

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Vehicle And Boat Registration Renewal Nebraska Dmv

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

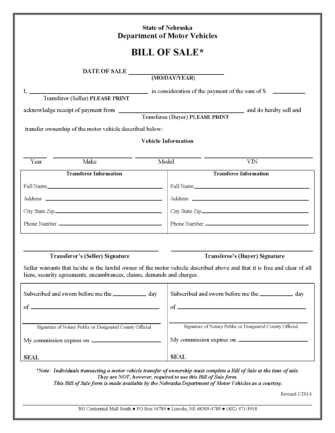

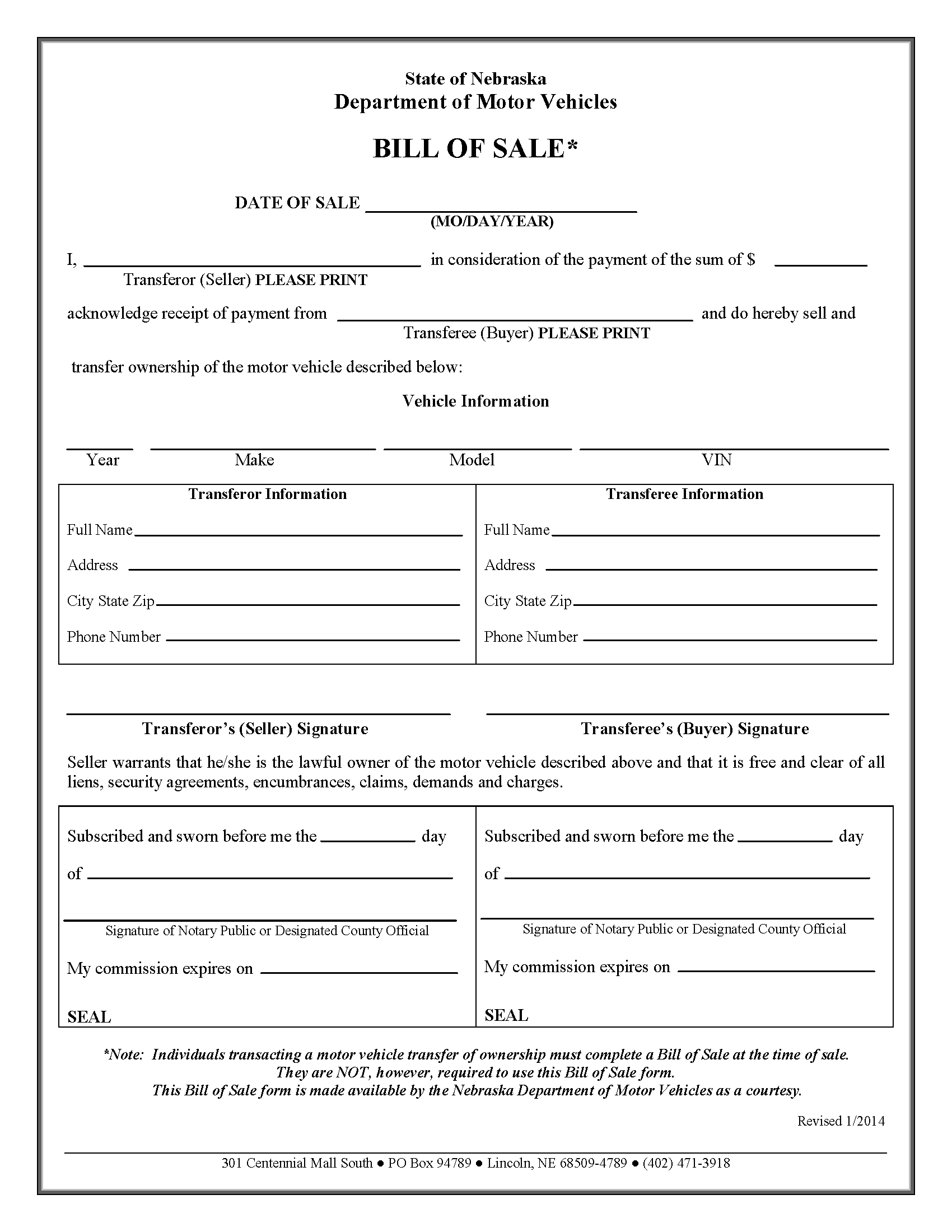

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

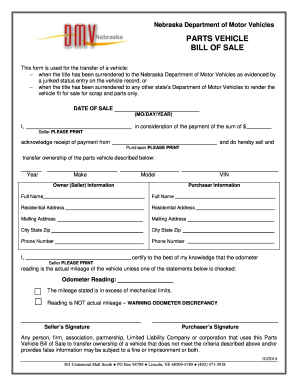

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Ford Autocar Motor Car Advert 1936 Ford Model Y Motor Car Car Advertising Car Ford

Free Nebraska Motor Vehicle Dmv Bill Of Sale Form Pdf

Shop Furniture Appliances Electronics Flooring Home Decor Nebraska Furniture Mart Luxury Bedding Collections Furniture Shop Nebraska Furniture Mart

Old Illinois License Plate Tag White Blue Mk3845 Auto Garage Etsy License Plate Vintage License Plates Garage Decor

Tampa Bmw Suspension Repair At A J German Motorenwerke When Your Car Makes Noise When Turning Call The Experts In German Auto Re Tampa Bmw Repair

Form 6 Fillable Nebraska Sales Use Tax And Tire Fee Statement For Motor Vehicle And Trailer Sales 8 2012

Nebraska Vehicle Sales Tax Fees Calculator Find The Best Car Price

Do You Really Want This Ford Mustang Mustang Ford Mustang Suv

All About Bills Of Sale In Nebraska The Forms And Facts You Need